Today’s estimated read time: 3 minutes 35 seconds

1. Business idea of the Week: E-Bike Rentals

Rental business are great. They’re the gift that keeps on giving.

You buy your materials once, and they continue to make you money forever (or until they break).

And consumers tend to agree. The “sharing economy” is on the rise as more consumers would rather rent what they use instead of buying.

Rentals of consumer goods generated $60 billion in revenue in the United States last year, excluding vehicle and home rentals - Global Data

Another trend we see? Electric bikes are on the rise!

This news station found that e-bike sales have nearly doubled from 2020 to 2021.

And the craziest part - E-bikes outsold electric cars in 2021.

While 608,000 electric cars and trucks were sold in 2021, more than 880,000 e-bikes were also purchased - Bicycling.com

But what’s the worst thing about e-bikes? They’re very expensive.

A decent e-bike will cost you around $1,500 - $3,000. Thats a lot for a bike, and more than most consumers will spend on a bicycle.

Trust me. I have one. It was expensive…. but totally worth it.

The Idea: An electric bike rental business. This service will allow both tourists & locals to rent your e-bikes for a few hours, or even a few days.

How to get started: Since this is a rental business, the first thing we need is an actual electric bike. I recommend the Super 73 S-1 or S-2, but this will be up to you.

For this example we’ll use the S-1, which will run you about $2,200. Let’s assume you purchase 2 up-front for $4,400.

Here’s a a breakdown of days until ROI at a few different price points:

$90 / day = 25 days until breakeven.

$80 / day = 28 days until breakeven

$70 / day = 32 days until breakeven

Pretty good investment if you ask me…

But obviously theres a lot more that goes into this. Like, where do your customers come from? Where do you store your bikes? How do you set up payments and make sure no one steals them?

I don’t have the answers to all these questions but here’s some ideas.

How to find customers: Set up a professional website with a website builder such as Rentle.io. This site will allow you to accept rental bookings, payments, and inventory management.

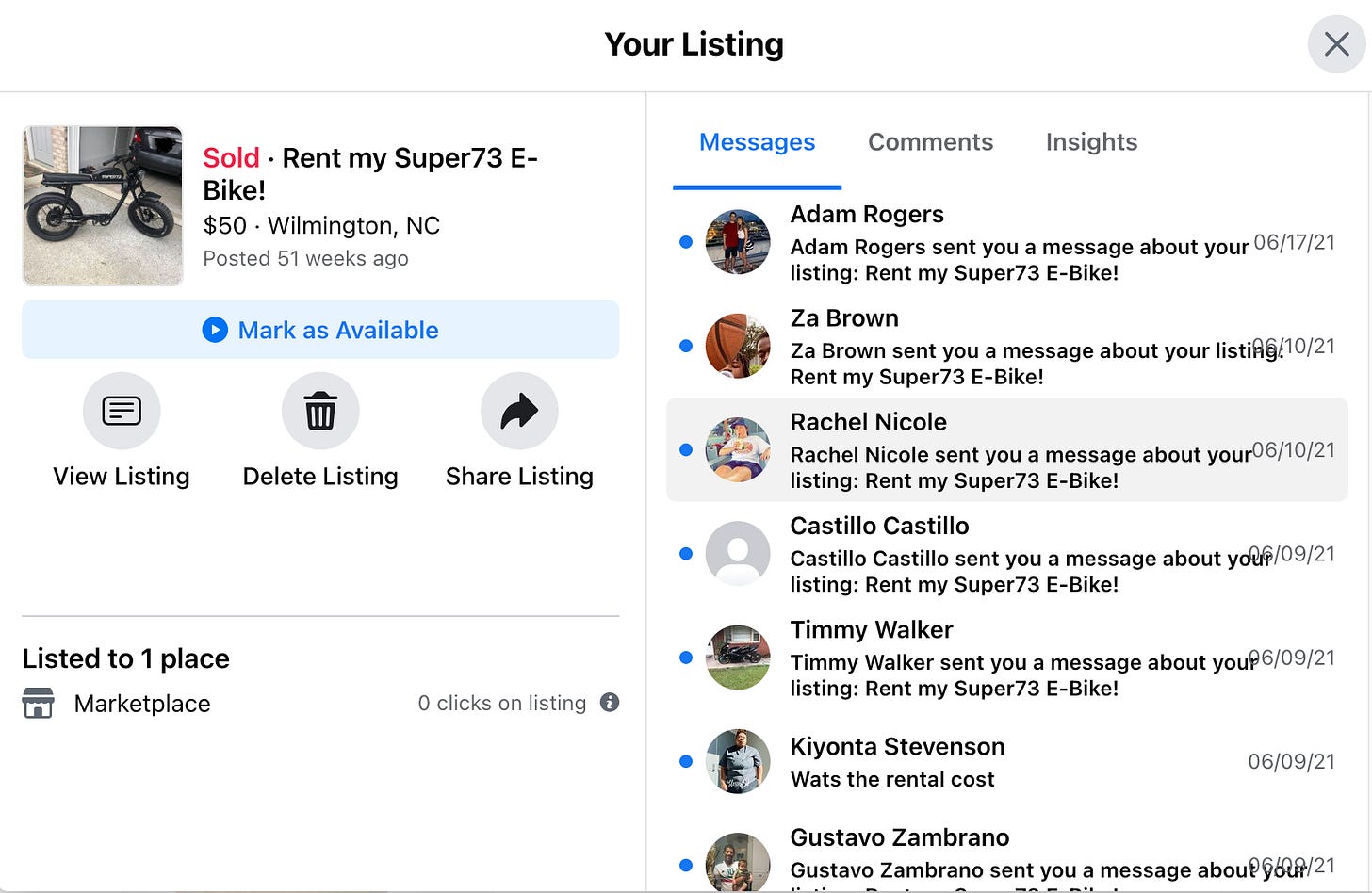

Next, we can make a listing on FB marketplace for some free marketing. I tried this as an experiment last year, and received 8 messages in the first 2 days.

You can start this out from your garage and deliver the bikes to your customers, and look for rental space once the business had some momentum.

You will also need to do some research to learn more about rental contracts, insurance needed, bike repairs, and how to charge for damages, but I won’t get into all of that.

Things I like about this business:

Low startup cost (if you start small). You can start with 2-4 bikes, and buy more as you grow. 📈

Low overhead. No need for a bunch of employees when the bikes are your service. 🥷

Its a rental business! Buy your products once, sell them forever. 🚲 🚲

Let me know what you think!

2. Are you an Entrepreneur or Investor?

Investors and entrepreneurs are both key roles in the world of business.

Although entrepreneurs and investors often work very closely together, and some people claim to be both, most people are programed to be one or the other.

An entrepreneur is defined as:

A person who organizes and operates a business or businesses, taking on greater than normal financial risks in order to do so.

An investor is defined as:

A person or organization that puts money into financial plans, property, etc. with the expectation of achieving a profit.

In simple language, an entrepreneur figures out how to build, operate, and monetize the boat. An investor gives them money to build it, expecting to make more money.

Here are a few questions to understand if you’re an entrepreneur or investor:

Do you constantly think about what could go wrong?

If yes, you’re better suited for investing. As an entrepreneur you often have to only think about what could go right.

Do you think about the possibility of something working, or the probably?

Entrepreneurs focus on pushing the boundaries of what’s possible, while investors focus on the probability of something working.

Do you have laser focus on one thing, or do you like to diversify in a few different areas?

Entrepreneurs need to put all of their focus and energy into making that one thing happen, while investors diversify into different ventures to mitigate risk.

Brad Gerstner - Founder and CEO of Altimeter Capital talks about the time he was told that he’s not a great entrepreneur, but is a great investor:

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

And yes… he’s a billionaire.